“Crypto Cryptogram Wallets: Unraveling the Secrets of Liquidity Mining and Continuation Patterns”

Few concepts in the cryptocurrency space are as interesting as cryptography, wallet addresses, liquidity mining, and continuation models. These seemingly unrelated terms have become staples in the crypto community, and understanding their intricacies can provide valuable insight into how this rapidly evolving field works.

Crypto: The Mysterious Key to Cryptocurrencies

Cryptocurrencies, such as Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC), are digital or virtual currencies that use cryptography to secure financial transactions. Unlike traditional fiat currencies, cryptocurrencies operate on decentralized networks where transactions are recorded on a public ledger called the blockchain. The unique nature of cryptocurrencies makes them an attractive platform for speculation, investment, and trading.

Wallet Addresses: The address book of a cryptocurrency wallet

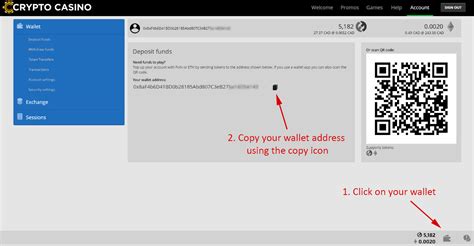

A wallet address is a unique identifier assigned to a cryptocurrency wallet. It serves as a key to unlock your digital assets, allowing you to send, receive, or transfer cryptocurrencies between users. Wallet addresses are typically 42 (or more) characters long and are usually displayed in hexadecimal format. When creating a new wallet, users are required to choose a username, password, and other security measures to protect their account.

Liquidity Mining: The Art of Market Liquidity

Liquidity mining is a process that allows cryptocurrency exchanges and market makers to provide liquidity to the markets in which they operate. By maintaining a large number of wallet addresses and actively participating in the supply chain, these entities create a network effect that increases the overall value of their assets. Essentially, liquidity mining allows users to access a wider range of cryptocurrencies, thereby facilitating greater market volatility.

Continuation Model: A Unique Algorithm for Cryptocurrency Rewards

Continuation models refer to a specific algorithm that some cryptocurrency exchanges and platforms use to reward users for holding or participating in the ecosystem. This algorithm typically involves creating a new token or asset based on existing tokens, allowing holders to benefit from the increased market value. Here are some notable examples of continuation models:

- Binance Coin (BNB) Rewards: Binance rewards its users with BNB tokens for participating in the platform’s liquidity mining and trading activities.

- SushiSwap Continuation Model: SushiSwap, a popular decentralized exchange, has introduced a continuation model to reward its users by creating new tokens based on existing ones.

Uncovering the Secrets of Liquidity Mining and Continuation Patterns

Learning about cryptography, wallet addresses, liquidity mining, and continuation models will give you valuable insight into how this rapidly evolving field works. To get started:

- Learn the basics of cryptocurrency, including wallets, transactions, and exchanges.

- Learn about the different types of cryptocurrencies, such as tokens and smart contracts.

- Learn how liquidity mining works and its impact on market volatility.

- Explore continuation models and their applications in the cryptocurrency space.

By delving into these concepts, you will gain a deeper understanding of the complex relationships between cryptocurrency wallets, liquidity mining, and continuation models. This knowledge will allow you to make informed decisions about your cryptocurrency investments and trading strategies.