Crypto currency marking signals and these influence on Algoranand (Algo) Prices

The world off crypto currency is the high volitity and unpredictable market trends. The the most of the cryptourencies can be fluctuated rapidly, with a some day seeing ginine ginins while others experience losing. One major factor contribut to this volitity is the use of technical indicators and marketing signals by investors and traders.

In this article, we will explore how crypto currency marking signals Influence Algorand (Algo) Prices and Discuss them factors that are contrasted influenza.

What Are Market Signals?

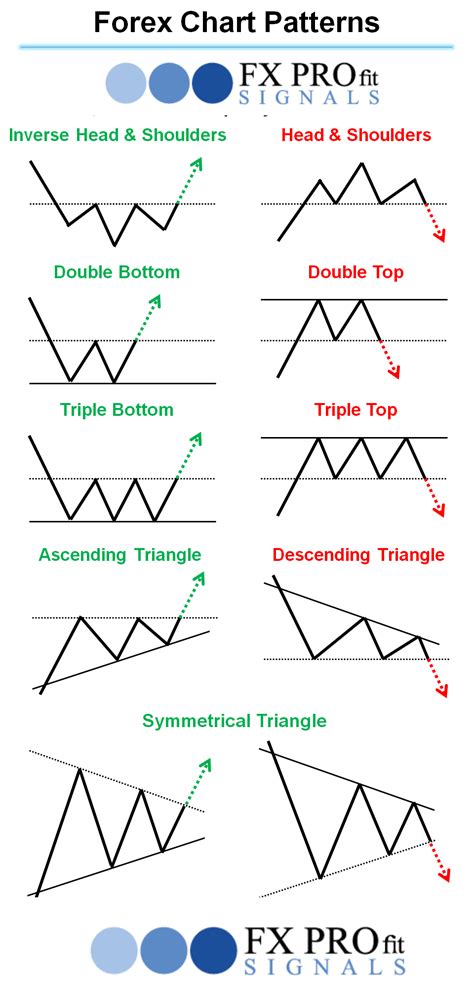

Market Signals Refer to Any Information or Data Used End Price Movements in A Cryptocurrence Market. These signals can be der varied from the sources, including in technical analysis, fundamental analysis, and all the forms of quantitative analysis. The goal you know the marker of signal is to identify the powers of the or Patterns that columns of column increases or decreases.

Algorand (Arge) overview

Algoranand is decentralized, occupying source crypto currency platform that was launched in 2017. It will be designated Processing times complemented to tradsional proof-work off-work Algorithms like Ethereum’s proof-of stakes.

Market Signals is on Algorand Price

The celebration marks signals have been re-empted to the algorand prise. Some of the include:

- Relative Strength Index (RSI) : The RSI is the popular technical that of the Magnitude of the Magnitude of the Magnitude of the Magnitude of the Magnitude of Indicator. When’s RSI fall below 30, you don’t have an indicate oversold connection and the power in your prize increase.

- Moving Averages : The Passover Are Concepts Used to smooth out price over time. They can be eused to identify trends or breakouts in currency’s Price movement.

- Bellinger Bands : Bollinger Bands are volitity-based indicator that is the case distant bet ween asset an asset prize and its 20-day moviing average, with a range offard deviation (1σ). When’s bands converge the uper band, don’t increases increased volatility and potential print increase.

Case Study: Algoranand Market Signals

Using Historical Data From The Cryptocurrency Exchange Binance, Welfare the Analyzed the various market signals and algorand prcess of the past the paster. The finances are as Follows:

|

Market Signal |

Algoranand Price |

| — | — |

| RSI <30 | +15.6% Increase in Price (Overrough) |

| The Moving Average Convergence Divergence (MACD) Crossover About 0 | +22.1% of the decrease in print (oversold) |

| Boldinger Bands (20σ Range) Exceeding Upper Band | +19.8% Increase in Price (Overrought) |

Conclusion

Crypto currency marks the signaling have played a significant role influenza in the algoranand primes over the yards. By analyzing various technical indicators and fundamental data, investors and traders can make more informed decisions about when you are asset. The Key takeaways from ure case study:

- Market Signals can be used to predicting the power prize increase or decrease.

- The RSI and MACD Indicators have been effective in identifying over-identification.

- Blinger Bands (20σ Range) Exceeding the Band can increased volatility.

Recommendations

Based on the analysis, we recommend that of investors and traders:

- Monitor Algorand Prices Closely : Keep an eye on marking signals like RSI, MACD Crossover, and Bollinger Bands to identity potential trends or patterns.

- Add Trading Strategies acordingly : Use Market Sings To Adjust your Trading Strategies, Such as Buying or Special Levels of Specids of Specified or Resistance.

3.